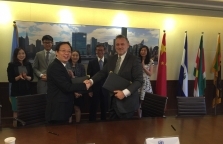

On May 25, 2016, after nearly half a year of negotiation, the Finance Center for South-South Cooperation (FCSSC) and the United Nation Social Impact Fund (UNSIF) officially signed a Memorandum of Understanding to collectively establish and manage the “UNSIF South-South Cooperation Fund”. Chairman Cai E-Sheng and Director-General Wu Zhong from FCSSC, the Global Chief of UNSIF David Galipeau and other related figures were present at the signing ceremony.

According to the MoU, other than the establishment of the fund, FCSSC and UNIIF aims to define the cooperation framework for both parties to support each other and benefit from each other's strategic knowledge, expertise, resource mobilization initiatives and working procedures. Besides, the Parties recognize the benefits to be derived from increased collaboration, cooperation and interaction in the fields of private sector inclusion in the development process, social and impact M/SME development, and the mobilization of blended finance and social impact capital. Moreover, the Parties will co-mobilize grant donations and social impact capital financing for the fund to be targeted towards investments in science, technology and innovation, new and rural economic sector development, telecommunications, sustainable infrastructure and housing and so on. The Parties will also conduct joint research and policy forum to promote South-South Cooperation and financing for development agenda. A UNSIF project office will be established in Hong Kong to coordinate local stakeholder coordination, resource mobilization and partner relations.

The Chairman of FCSSC, Mr. Cai E-Sheng stated that the UN Millennium Development Goal proposed in 2000 mainly concerned about South-South countries against poverty. However, after fifteen years, environmental issues and social conflicts, which challenged the sustainable development to a great extent, had gradually drawn increasing attention worldwide. Therefore, FCSSC wanted to collaborate with UNSIF to devote jointly into the realization of UN 17 Sustainable Development goals (SDGs).

“We’d better attend to the SDGs in a tangible way,” David Galipeau responded, “And that’s the reason why we want to cooperate with FCSSC to make use of your financial expertise. Though I’m sure our cooperation will be mutually beneficial, we should bear in mind that the start will always be hard work. So let’s face the challenge together.”

While in Chairman Cai’s opinion, the “hard bone” or the toughest obstacle the Parties face was, “how to balance between social development and business interest”. As a newly established fund, the “UNSIF South-South Cooperation Fund” aims to act as a financial platform to direct investment under market rules, especially the capital from the private sector. Holding this expectation, the question lies on “how to encourage the private capital to participate in those investments with social benefits other than pure business interest?”

David Galipeau agreed that it was a challenging task, and he thought one more social aspect should be considered for Public-Private Partnership (PPP) model and then developed into Public-Private Social Partnership (PPSP). For instance, China has been an export giant with a lot of private companies cooperating with the government. However, most of these companies export everyday only for financial gain, without any realization of their value of social impacts. “Actually, several financial giants like Goldman Sachs, JP Morgan and Blackrock, are now exploring to create their own social impact funds. However, our advantage lies on the reputation, resource and experience support from the United Nations. Thanks to the help of UN’s moral support, we’ll be very selective to find out those South-South investments with good social impacts.

The “UNSIF South-South Cooperation Fund” will be initiated from cross-border investment along the “One Belt One Road” region and lay extra stress on infrastructure construction and international capital flows in the green industry.

Backgrounds:

Finance Center for South-South Cooperation (FCSSC) is a non-governmental, non-profit international organization founded in Hong Kong in April 2014. It is an integral platform which specializes in providing experience, knowledge, productivity and financing supports for South-South Cooperation and aims to promote pragmatic cooperation and partnerships between governments of developing countries, private enterprises, multilateral development institutions and international development assistance organization. FCSSC provides comprehensive solution plans for South-South Cooperation projects and uses financial services as means to assist countries of the global South to propel industrialization and achieve sustainable development, in an effort to make valuable contributions to the implementation of the 2030 Agenda for Sustainable Development.

United Nation Social Impact Fund (UNSIF) is a united investment platform, established in January 2015 by the Multi-Partner Trust Fund Office, which aims to expand social impact. As the first organization of this kind jointly established by the United Nations Development Programme, the United Nations Environment Programme, the United Nations Population Fund and the United Nations Capital Development Fund, represent the United Nations’ commitment to grow the Impact ecosystem.

Agenda 2030 - the sustainable Development Goal is 17 sustainable development goals adopted by all 193 Member States of the United Nations to overcome the most important economic, social and environmental challenges in a comprehensive way for the period 2015 to 2030.

Public-Private Partnership is a government service or private business venture that is funded and operated through a partnership of government and one or more private sector companies. PPP involves a contract between a public sector authority and a private party, in which the private party provides a public service or project and assumes substantial financial, technical and operational risk in the project.